The cryptocurrency market is experiencing a phase of stabilization as traders adjust their expectations ahead of the forthcoming Federal Open Market Committee (FOMC) statement. Despite this general sense of calm, the market remains sensitive to the anticipated direction of Federal Reserve policies, which significantly influence trading strategies. Notably, XRP, Solana (SOL), and Ethereum (ETH) are showing robust structural support in their charts, buoyed by healthy network activity and steady on-chain demand. The next significant market movement will likely hinge on how traders interpret today’s policy announcements.

Market Overview:

Following last week’s selloff, the trading environment has shown signs of improvement. Bitcoin (BTC) is currently stabilizing near its short-term support, and this sentiment shift is starting to impact other major altcoins. As liquidity conditions tighten, many altcoins are entering a consolidation phase characterized by lower volatility.

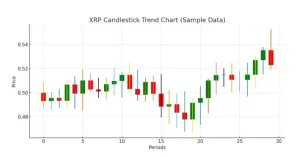

- XRP is currently trading just below $0.52, indicating minor accumulation levels.

- Solana is firmly holding around the $180 price mark, defending its mid-range support.

- Ethereum remains close to $3240, fluctuating near its short-term moving averages.

An intriguing development is the 3% increase in stablecoin inflows to centralized exchanges over the last 24 hours. This suggests a cautious repositioning by traders without displaying overt risk-off behavior.

Bitcoin & XRP Price Analysis

Daily Timeframe

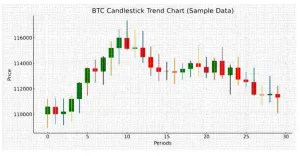

Bitcoin is currently situated between its 100 and 200-day moving averages (DMA), indicating a potential compression phase that could precede a bout of heightened volatility. The supports are as follows: $108K-$109, $115K-$116, with liquidity targets set at $120K-$122 prior to reaching the all-time high (ATH) level of approximately $126K. A confirmed breakout above $115K could signal a return to higher liquidity levels, while a rejection could drive BTC back toward the $108K range lows. Overall, Bitcoin’s structure remains resilient within a healthy on-chain liquidity channel.

XRP Price Analysis:

Currently, XRP is on a sell signal, moving in alignment with its previous trajectory. Daily and 4-hour structure supports are established at: $0.50-$0.515, $0.54-$0.55, and the range high at $0.56-$0.58. XRP’s network continues to perform reliably for institutional payments, which reinforces its stable framework. The activation of wallets is consistent, revealing no signs of weariness in daily transactions. A successful breakthrough of the $0.54 resistance could propel XRP toward mid-range support near $0.58. However, broader market pressures might suppress prices unless they catalyze a reversal.

Transaction Health and Network Activity: On-Chain Data

Settlement Network Stability: XRP

XRP’s throughput continues to exhibit strong utilization in cross-border payment channels, evidenced by an increase in daily transactions that remain stable. This throughput serves as a robust indicator of ongoing network activity.

High-Performance: Solana

Solana is demonstrating exceptional engagement within the smart-contract landscape, with total value locked (TVL) exceeding $11 billion in active DeFi programs, NFTs, and gaming. The on-chain throughput indicates impressive user interaction, even amidst a moderate consolidation phase.

Ethereum: Layer-2 Expansion and Core Network Strength

Ethereum’s network is advancing towards improved efficiency with a marked rise in Layer-2 solutions that are absorbing more transactional demand. The active staking process and robust wallet activity across major L2s affirm Ethereum’s position as the cornerstone of the Web3 ecosystem.

Improved liquidity conditions have been noted across major altcoin pairs, as spreads narrow and market makers resume operations. Volatility indicators such as Average True Range (ATR) and Bollinger Band width suggest a compression period, typically symptomatic of an impending expansion phase. This scenario indicates limited downside risk unless major macroeconomic shocks occur.

- XRP is trading close to its short-term moving averages, showing initial signs of structural stability.

- Solana continues to hold a vital support area in the $165–$175 zone, a level where buyers frequently enter the market.

- Ethereum sustains a mild upward trend, characterized by a series of higher lows despite the overarching consolidation.

Poain Insights: Interpreting the Current Market Environment

Utility as a Core Strength Indicator

According to Poain analysts, network activity holds more weight than short-term price fluctuations in assessing the long-term appeal of a blockchain. The on-chain utilization of XRP for settlements, Solana’s influential transactional throughput, and Ethereum’s dominance in Web3 applications all showcase significant underlying value.

Liquidity Behavior Across Exchanges

Current liquidity patterns across exchanges indicate that traders are refraining from deploying overly speculative strategies, choosing instead to exercise caution in light of macroeconomic uncertainties. This behavior aligns with the ongoing trend of crowd-sourced trust as the market approaches the FOMC announcement.

Stablecoin Flow Trends

Recent trends in stablecoin flows reveal a slightly risk-averse stance among investors. According to Poain’s data, traders are maintaining liquidity on exchanges, preparing for emerging opportunities rather than withdrawing funds.

Institutional Hedging Activity

There is an observable uptick in hedging activity among institutional investors utilizing off-exchange instruments. This suggests a strategic approach aimed at protecting against uncertainties until macroeconomic conditions clarify.

About Poain BlockEnergy Inc.

Poain BlockEnergy Inc. (Company Number 20201594933), founded on July 8, 2020, and headquartered at 1401 Lawrence Street, Denver, Colorado, focuses on the pre-sale and staking of Poain Coin (PEB). The company specializes in delivering data-driven research and transparent market insights, helping readers comprehend digital asset dynamics through clear, factual on-chain analysis.