World Liberty Financial (WLFI) has slipped into deeper red. Trading at $0.187, the WLFI price has declined by almost 20% in the past 24 hours — a sharp move for an asset that was only launched days ago.

The charts and on-chain data both suggest one thing: sellers remain firmly in control of the coin. And there might be some more price weakness along the way.

Sell Pressure Floods Exchanges

In the past 24 hours, over $23 million in WLFI has moved to exchanges, amplifying sell pressure significantly. This mass transfer explains the sharp decline where the WLFI price cracked below $0.20 despite a brief bounce attempt. Essentially, the market is inundated with sellers eager to offload their holdings.

Diving into the specifics, we can break down the recent activity:

- Smart money balances saw a nearly 2.8% decline, indicating that traders looking for quick flips are also exiting the market.

- Public figure addresses have also shown a slight reduction, pointing to diminishing conviction from influencer-backed wallets.

- Whale balances increased marginally by 0.43%, but this uptick has had minimal effect compared to the overwhelming inflow to exchanges.

Interestingly, even the top 100 addresses increased their holdings by 0.25%, bringing their total to 98.39 billion WLFI. However, considering the token’s distribution score of just 5—where the largest holders control over 96% of the supply—this is likely just internal reshuffling rather than a true accumulation signal. The apparent lack of impact on exchanges means it hardly qualifies as bullish for WLFI’s price trajectory.

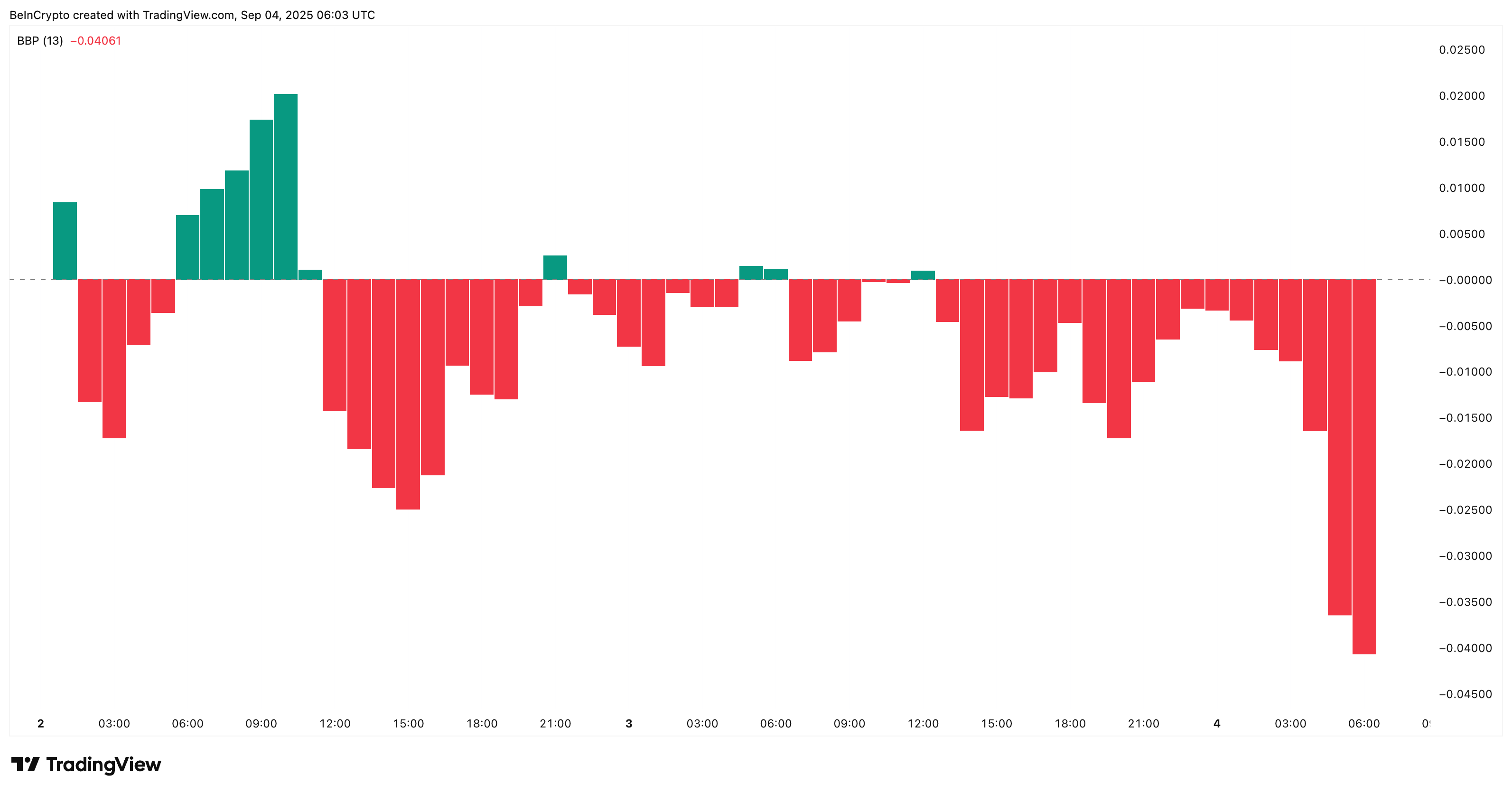

The Bull–Bear Power (BBP) indicator further corroborates this narrative of seller dominance. The BBP compares price extremes with a moving average to indicate momentum control. Currently, the histogram is deep in the red on the 1-hour chart, which is particularly relevant given WLFI’s limited trading history. This clearly suggests that bears are dictating market trends, with buyers yet to establish a significant counterforce.

WLFI Price and SAR Still Say “Down”

From a technical perspective, the situation remains equally dire. The Parabolic SAR (Stop and Reverse), which acts as a trend-following indicator, has consistently stayed above the WLFI price since September 2. On that day, WLFI briefly traded above the SAR line and sparked a quick rally, only to lose momentum almost immediately. Since then, WLFI has not been able to reclaim any territory above the SAR, signaling that the prevailing downtrend remains intact.

Unless WLFI can reclaim higher price levels, the indicators suggest a continued bearish stance. The most crucial level to watch now is $0.18; a fall below this threshold would likely confirm a bearish extension and open the path to potentially new lows. Conversely, a reclaiming of the $0.20 mark might signify the first signs of strength, with $0.21 serving as the next checkpoint for any meaningful recovery effort.

As it stands, WLFI’s price looks quite fragile. With ongoing heavy inflows to exchanges and smart money scaling down their positions, the bears continue to exert their control over the short-term outlook.